Hospitality

Know your rights!

You know what that means when someone pays you minimum wage? You know what your boss was trying to say? “Hey if I could pay you less, I would, but it’s against the law.”

~Chris Rock

If you work in hospitality as a tipped employees, chances are that your employer does not pay you full Florida minimum wage. Instead, you are likely paid a “tip credit” wage of $3.02 less than full minimum wage. However, there are strict legal limits to when an employer can pay you a “tip credit” wage instead of full minimum wage which are commonly ignored by employers, resulting in you being paid an illegal wage and entitling you to compensation for wage theft. Examples include excessive side work, an improper tip pool, or deducting “walk-outs” or the cost of broken inventory from your tips/wages.

Other common wage violations in the hospitality industry which may entitle you to compensation include off-the-clock time, failure to properly pay or calculate overtime, or failure to pay a wage at all (when you are paid “only tips”).

It does not matter if you “agreed” to conditions that resulted in an illegal wage, an employer may not pay a wage which is in violation of Federal and Florida law.

If you believe you are a victim of illegal wage practices, fill out our questionnaire for a case evaluation, and one of our attorneys will contact you with the results and what we can do to help!

Tip-generating work is work which may directly affect whether you receive a tip and the amount of that tip. Examples include greeting your customer, explaining the menu, taking orders, refilling drinks, checking on your customer, and bringing your customer their check. These activities involve a direct relationship and interaction with your customer. Your employer may pay you a “tipped wage” for time spent performing these duties.

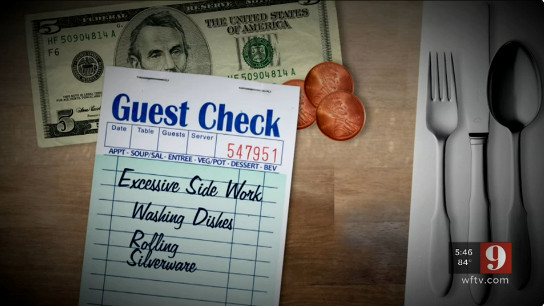

Side work is generally defined as work which does not directly generate tips, however is “incidental” or related to your tipped occupation. Examples include rolling silverware, brewing coffee, stocking glasses, sweeping your section, polishing silverware, and much, much more. Side work does not include tasks which are completely unrelated to your tipped occupation, such as cleaning bathrooms, picking up trash in the parking lot, cleaning windows, dusting, or performing managerial duties. For these tasks, your employer must pay full minimum wage for all time spent performing them.

There are three basic types of side work: opening duties, closing duties, and running side work. Opening duties are performed at the beginning of your shift prior to taking your first customer, closing duties are at the end of your shift, and running side work is during your shift. Side work is not directly tip-generating, and in fact can take time away from taking care of customers, resulting in lower tips.

Federal and Florida law allows employers to pay a reduced, “tip credit” wage for time spent doing side work, but only under strict conditions: the side work may not exceed 20% of your overall shift, and the side work may not be for more than 30 consecutive minutes at a time.

If you are being paid a reduced “tip credit” wage, your employer may require you to participate in a “tip pool”, but only under certain conditions. Generally, your employer may not require you to “tip out” the company itself or any other employees who are not engaged in a traditionally tipped position, such as kitchen staff, managers, expo, or other employees who do not directly interact with customers.

If you are a victim of wage theft, you may be entitled to more money than you think. Fill out our brief case evaluation questionnaire now and we will have one of our attorneys call you to discuss your rights and potential recovery!

Grossman Law, P.A. does not charge any kind of money up front, and if litigation is necessary, we do not take any percentage of the money we recover for your unpaid wages. We also cover all the costs associated with your claim, and if we do not recover anything, you do not have to reimburse us for anything. If we take your case, we also take the risks associated with the cost of your case.

Click the image below to see Orlando’s News Channel 9’s story about side work and illegal wage practices in the hospitality industry, featuring Mr. Grossman:

Click the image below to see Orlando’s News13 story about OrlandoTipPool, Grossman Law’s charity work to support hospitality workers who struggled during COVID-19 shutdowns:

Click the image below to see Orlando’s News Channel 9’s story about workers alleging a local Moe's failed to pay them wages:

Servers and Bartenders, Know Your Rights and Take Back the Power!